Investing in Italy can be a highly valuable opportunity, especially when supported by an experienced consulting partner. According to the Italian Trade Agency, between 2003 and 2022 the country welcomed 3,571 foreign direct investment (FDI) projects, totaling 161.91 billion USD and creating over 339,000 jobs. Most of these projects (87.7%) were new “greenfield” initiatives rather than simple acquisitions.

Table of contents

Italy offers significant advantages—let’s explore them together:

Italy offers significant advantages—let’s explore them together:

- a high–value-added manufacturing ecosystem, with strong specializations in mechanics, fashion, automotive, and components.

- universities and research centers spread across the country. • an extraordinary cultural and historical–landscape heritage that makes the Peninsula an attractive destination for investments in tourism, agri-food, and luxury sectors.

- an extraordinary cultural and historical–landscape heritage that makes the Peninsula an attractive destination for investments in tourism, agri-food, and luxury sectors.

- availability of public grants (such as the National Recovery and Resilience Plan (NRRP), Italy’s National Recovery and Resilience Plan) dedicated to the energy and digital transition.

- a geographically strategic position: Italy is an “aircraft carrier” in the Mediterranean and a bridge to other markets, such as North Africa and the Middle East.

Challenges that can turn into opportunities

It’s important to note that the country is not without challenges: slow bureaucracy, a digital divide (especially between the North and South), relatively high business costs, and regulatory complexity.

This is where a management consulting firm like JO Consulting—with over 27 years of experience—can support you in accessing European and national funds, becoming a trusted reference point for all international investors looking to enter the Italian market.

What you really need to invest in Italy

For an international investor, entering a complex market like Italy requires more than capital; it requires specialized guidance capable of:

1. Selecting the best incentives

There’s no such thing as a “one-size-fits-all” incentive. It’s necessary to evaluate European calls, national grants, regional funds, tax credits, and more. A skilled consulting firm guides the investor toward the most suitable opportunities—those best aligned with the project and its sector.

2. Preparing documentation and managing reporting

Most funding programs require technical annexes, business plans, environmental assessments, financial checks, and periodic reports. Mistakes in these phases can lead to exclusion from funding.

3. Coordinating stakeholders

From local institutions to on-site professionals (lawyers, engineers, accountants), and through to administrative authorizations—what’s needed is a network that “speaks Italian” and understands local dynamics.

4. Supporting corporate, tax, and legal structure

Strategic decisions must be considered: whether to set up an Italian legal entity or a branch, adopt consolidated taxation, or leverage special regimes (e.g., patent box, new resident regime, etc.).

5. Monitoring and mitigating regulatory risks

A competent consultant keeps track of updates, compliance, and regulations to effectively monitor and mitigate legal and regulatory risks.

Real-world cases: major investments in Italy

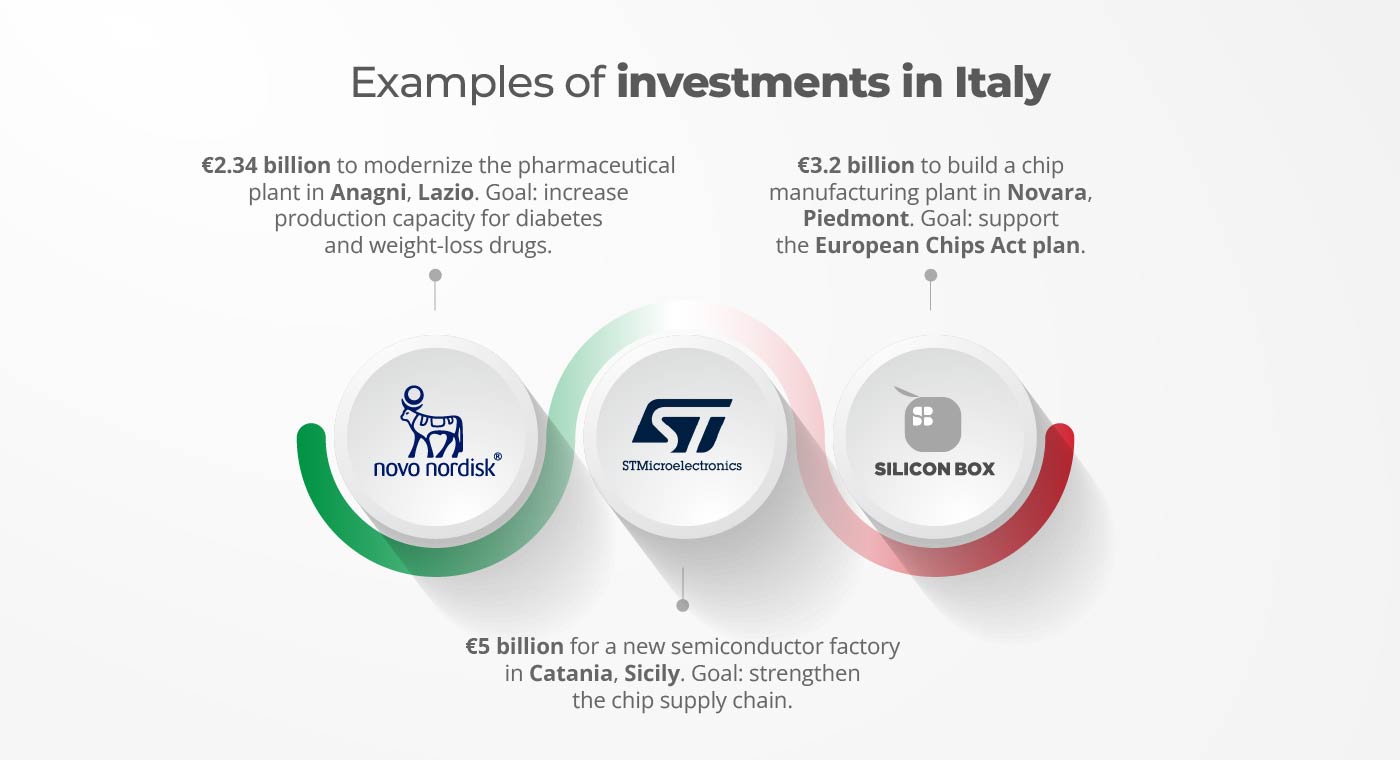

Recent examples help illustrate how qualified international players have approached the Italian market.

Novo Nordisk

In 2025, Novo Nordisk announced a €2.34 billion investment to modernize a pharmaceutical plant in Anagni (Lazio), with the goal of increasing production capacity for diabetes and weight-loss drugs. The Italian government declared the project of “national strategic interest,” streamlining administrative procedures. Around 800 new jobs are expected, bringing the total workforce at the site to 1,500.

This is a paradigmatic case: a foreign company not only investing but also obtaining privileged treatment in terms of authorization processes, thanks to institutional support (source: Reuters).

STMicroelectronics

STMicroelectronics announced a €5 billion investment for a new semiconductor factory in Catania, with around €2 billion coming from state aid. The project is part of the European strategy to strengthen the chip supply chain. The site is expected to become operational in the second half of the 2020s (source: Italian MIMIT).

Silicon Box

A Singapore-based company announced a €3.2 billion plan to build a chip manufacturing facility in Novara, Piedmont. The project will create 1,600 direct jobs and significant benefits for the local supply chain. The Italian government has committed to supporting the initiative with funding and authorization assistance, also within the framework of the European Chips Act (source: Financial Times).

Choose JO Consulting

Investing in Italy can be complex—but with an experienced consulting firm by your side, it can become a highly rewarding opportunity. JO Consulting identifies the most suitable measures based on the investor’s profile and sector, prepares all required documentation, supervises project reporting, and manages relationships with funding bodies.

For international Clients, we are the ideal management consulting partner: we provide support in selecting local professionals, managing relations with public authorities, and accessing all available funding opportunities.

Contact us today! Fill out the contact form at the bottom of the page, speak with a multilingual consultant by calling +390950936053, or write to us on WhatsApp—we’ll get back to you as soon as possible.

JO Consulting: invest successfully in Italy